Four Ridiculously Undervalued Stocks For June 2021

About The Frugal Prof:

The Frugal Prof has been a portfolio manager for the past 24 years. He has an MBA from the Johnson School at Cornell University. He has been featured by the Financial Times, Reuters, and CNBC.

About Value Gems:

I’ve been a professional money manager for 30 years. I wrote a very popular column for an investing platform called Seeking Alpha. I had nearly 2,500 followers and had some extremely profitable recommendations.

Now, it’s time for a new venture. This is it. My goal is to deliver value added content that will make you a lot of money.

SUBSCRIBE NOW AND SAVE 25% OFF THE REGULAR PRICE - DETAILS AT THE BOTTOM OF THE PAGE

Thank you for your support.

Legal Disclaimer: The FrugalProf is not a registered investment advisor. Investing involves risk. Financial information provided is believed to be accurate but we are not responsible for inaccuracies. I may own these securities for myself or in accounts that I manage. Past performance is no guarantee of future returns. Previous Recommendations:

Recommendations from 4/2 Edition of Value Gems: Full Details Here

$WW Weight Watchers: +14.95%

$MDP Meredith: +26.2%

$DGX: Quest Diagnostic: -.009%

$DLX: Deluxe Corp +9.02%

$VGR: Vector Group +1.62%

Brief Overview of Value Investing:

Value investing is about minimizing risk.

Ben Graham created value investing because of his painful experiences losing money in the Great Depression.

Graham's losses in the 1929 crash led him to hone his investment techniques. These techniques sought to profit in stocks while minimizing downside risk.

Graham also stressed the importance of always having a margin of safety in one's investments. This meant only buying into a stock at a price that is well below a conservative valuation of the business.

More on Value Investing here

Recommendations for 6/4:

Biodelivery Systems: $BDSI: $3.62

BioDelivery Sciences International, Inc. is a specialty pharmaceutical company. The Company develops and commercializes, either on its own or in partnerships with third parties, applications of approved therapeutics to address unmet medical needs using drug delivery technologies. The Company develops pharmaceutical products aimed principally in the areas of pain management and addiction.

Earnings:

2021: .24

2022: .52

Why it’s attractive:

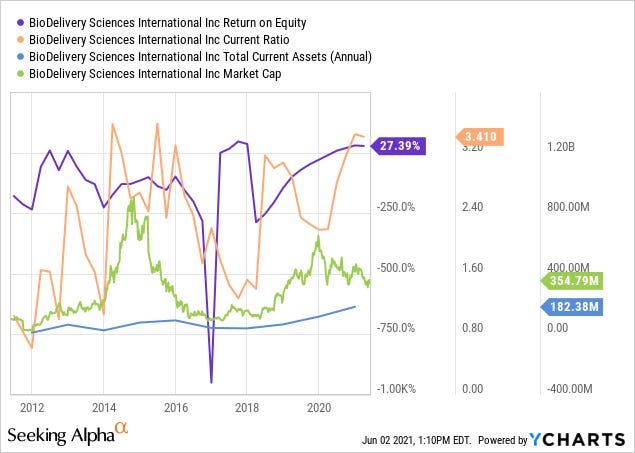

Incredibly high ROE (Return on Equity) above 27%. It’s also an asset rich company with a current ratio above 3. Benjamin Graham looked for companies with a current ratio above 2. And earnings are expected to jump 50% next year.

Diebold: $DBD $14.16

Diebold Nixdorf, Incorporated provides connected commerce services. The Company offers connected commerce solutions to financial and retail industries. The Company enables to automate, digitize and transform the banking and shopping. The Company’s segments include Banking and Retail. The Banking portfolio of products consists of cash recyclers and dispensers, intelligent deposit terminals, teller automation and kiosk technologies.

Earnings:

2021: $ 1.97

2022: $2.30

Why its attractive: The stock is around $14, which is the same level it was at three years ago. The p/e is at the low end of it’s 5 year range (10). Cash rich company trading at nearly 4x cash flow. Too cheap to stay down here.

A move above $17 would be very bullish technically

FootLocker: $FL $62.37

Foot Locker, Inc. is a retailer of shoes and apparel. The Company operates through two segments: Athletic Stores and Direct-to-Customers. The Company is an athletic footwear and apparel retailer, which include businesses, such as include Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction, Runners Point, Sidestep and SIX:02.

6/3 PRICE: $62.37

Earnings:

2021: $5.49

2022: $5.66

Why Its Attractive: The stock has made very little progress over the last five years, yet earnings are up nearly 50%. Some of their competitors are now bankrupt. Low p/e of 11 near the low end of the 5 year range plus double digit return on equity.

New highs above 80 would be very bullish.

GET THE FOURTH RECOMMENDATION BY SUBSCRIBING TO THE PREMIUM EDITION OF VALUE GEMS.

Subscribe and become a Premium Member to get access to ALL undervalued stock recommendations, special reports, and features.

How much would you pay for an experienced portfolio manager to filter the market of thousands of stocks and find the undervalued hidden gems?

My aim is to deliver solid content that makes you money. I hope you’ll consider subscribing.

The first 100 Paid Subscribers get a 25% discount.

Best,

The Frugal Prof