Review of Recent Stock Recommendations

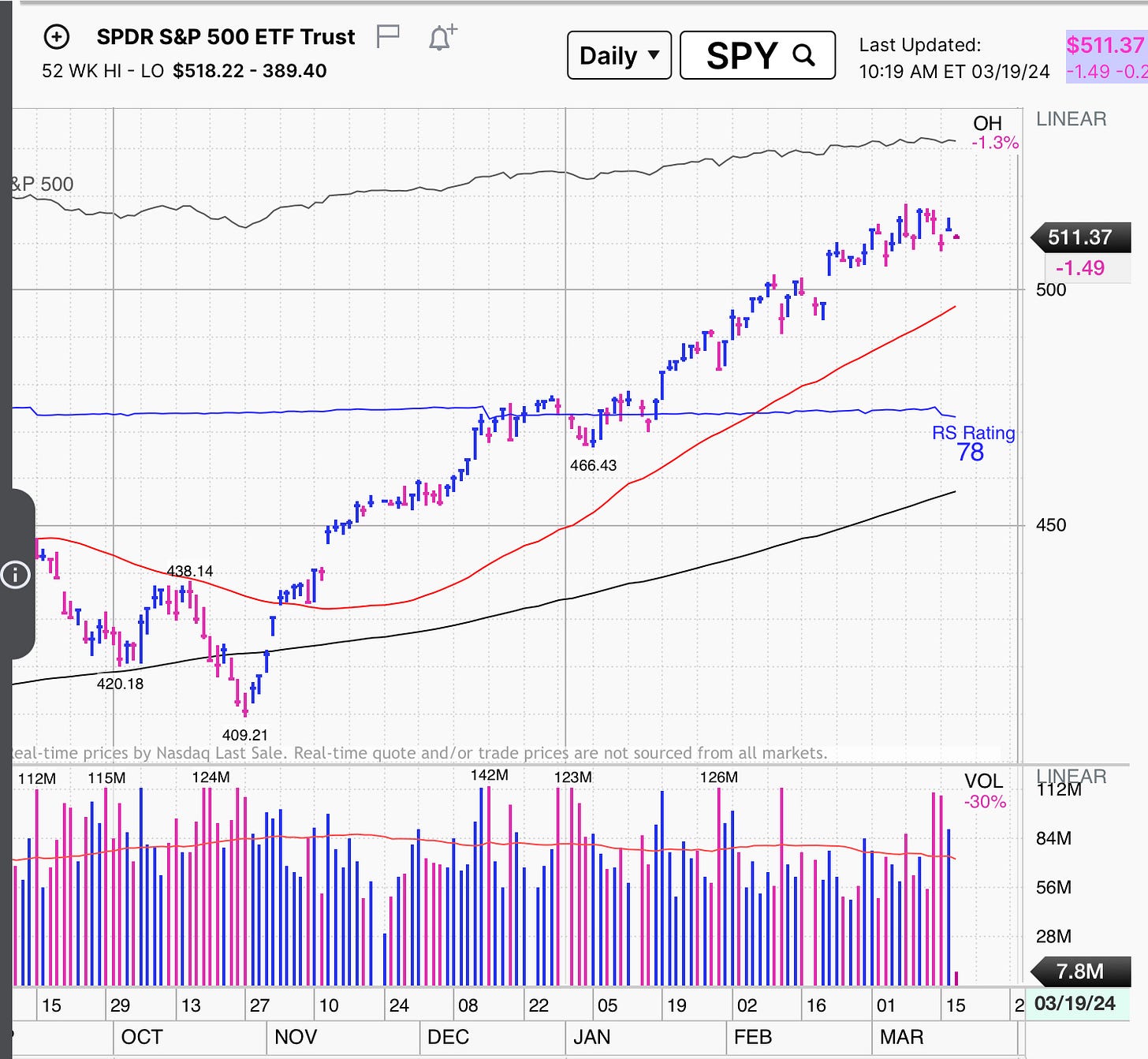

Market Overview:

Market is in a confirmed uptrend. We’re starting to see more distribution days, so that is worth watching.

Legal Disclaimer: The Author is not a registered investment advisor. Investing involves risk. Financial information provided is believed to be accurate but we are not responsible for inaccuracies. I may own these securities for myself or in accounts that I manage. Past performance is no guarantee of future returns. Some links provided may be affiliate links and the author may receive a small commission.

Recent Stock Recommendations:

Ultimately, my goal is to find true stock gems capable of exceptional performance. Stocks capable of gaining 700% over 3 Years.

Some picks have performed quite well. Some have been disappointing.

Here are the results so far.

These are the actual stock picks going back to October. This spreadsheet was updated a couple weeks ago. I will keep updating as we go along.

Recent picks are not included as this post is public and recent picks are for Premium Members.

Stocks are listed in chronological order by date of recommendation

Overall Performance: + 17.82%

Winners: 6/11

Average Gain: 25.12%

Losers: 5/11

Average Loss: -8.23%

Sell Discipline:

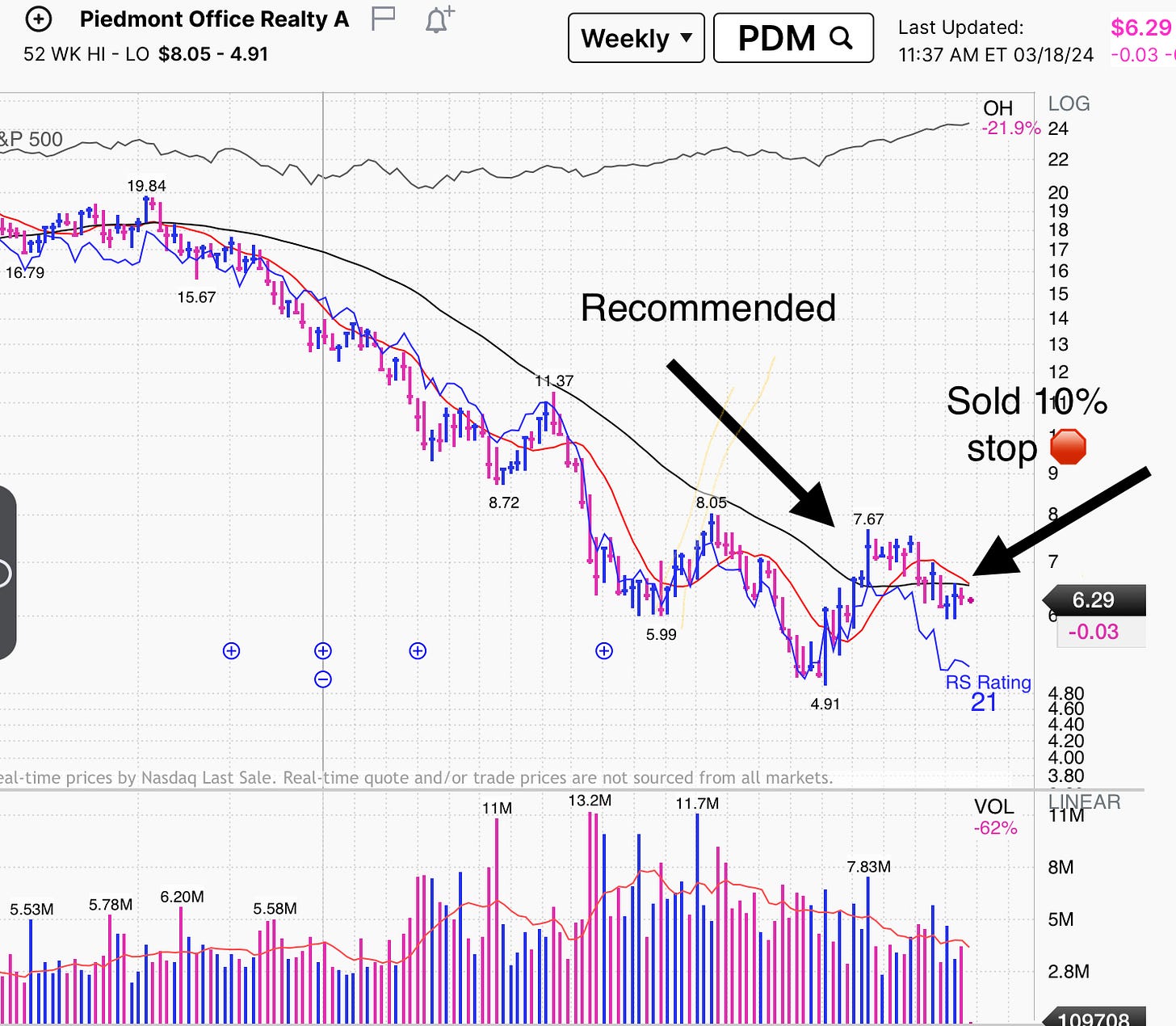

I want to reiterate our sell discipline. As you will see with the charts, stocks that fell 10% hit our sell stop and losses were capped at 10%.

We sell our losers and We let our winners keep growing. This is a very important concept.

Most of the losers are still undervalued and will be worth buying once they resume an uptrend.

However, to protect our capital we use a 10% sell stop.

Gap has been a great performer.

Taking profits at 100% gain is not a bad idea. It might be worth selling one third of your position.

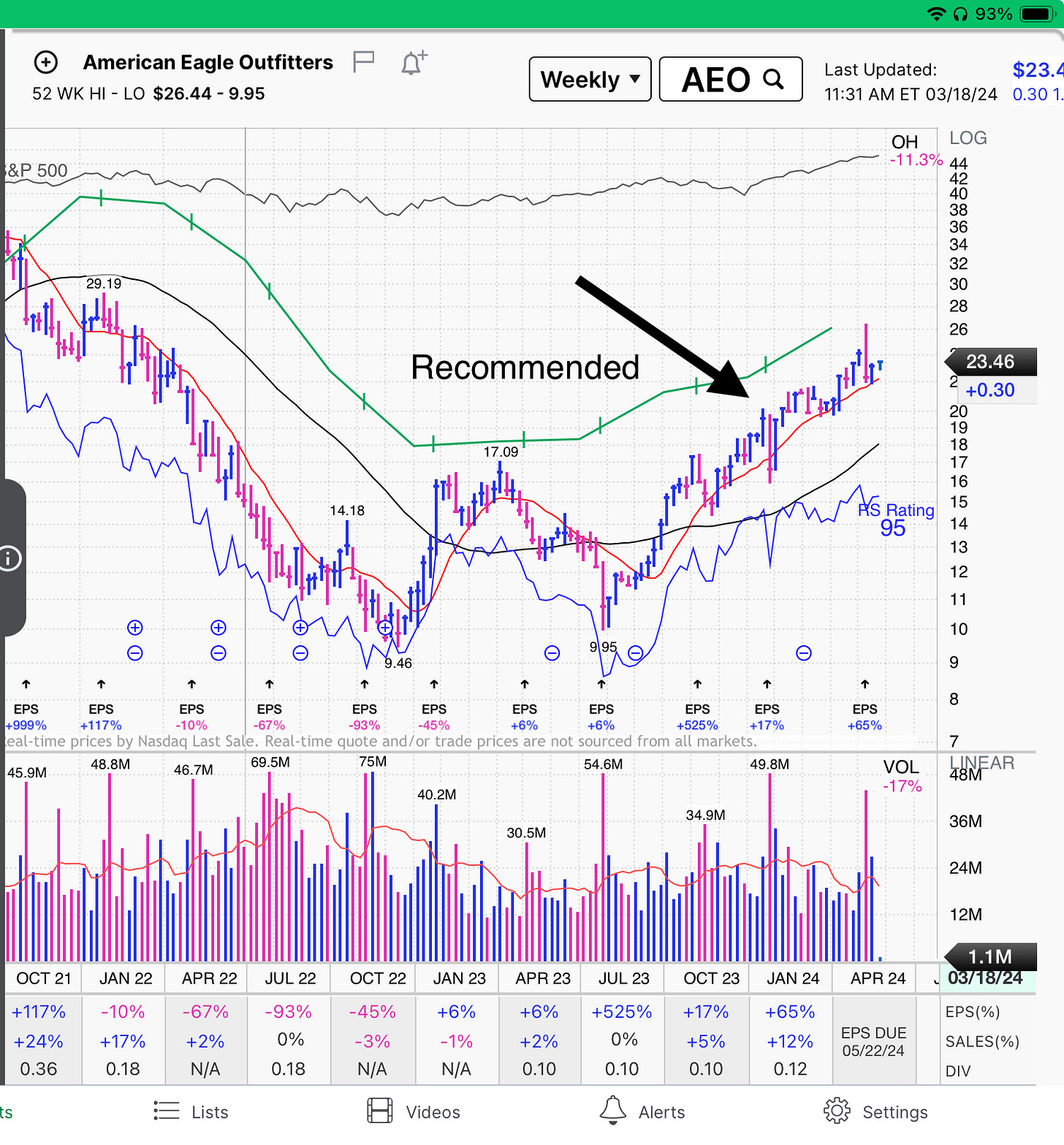

American Eagle has been another slow and steady strong performer.

Golden Ocean is acting great and is in this nice uptrend.

Yiren Digital has been a great performer.

Taking one third profits is not a bad idea.

Annaly is pretty close to break even. It will trade in line with rate cut expectations. I Still like it here.

Piedmont was a disappointment. It started an uptrend, but when rate cuts were postponed, it fell 10% and was sold.

Once it begins a new uptrend, I would consider purchasing shares again.

Jackson financial is acting great.

Docusign is another disappointment.

Sold after a 10% drop. Not looking to re add shares.

Danaos is pulling back to support. This is not a bad place to add to positions.

As I noted, Foot Locker is a volatile stock. Weak earnings torpedoed gains and it was sold for a loss. As I noted, the chart is erratic and it’s a hard stock to own, especially with a 10% sell stop.

Douglas Elliman was also sold for a loss. The NAR announcement and the delay of rate cuts have hurt the shares.

I am still watching the stock and would purchase them once they resume an uptrend.

Stay Tuned

Help us improve. What do you like? How can we get better?